reverse tax calculator nj

New Brunswick Newfoundland and Labrador Nova Scotia Ontario and Prince Edward Island. Reverse sales tax calculator 2017 Verified 3 days ago Url.

New Jersey Sales Tax Calculator Reverse Sales Dremployee

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to New Jersey local counties cities and special taxation districts.

. You can use an online reverse sales tax calculator or figure it out yourself with a reverse sales tax formula. 242 average effective rate. This app is especially useful to all manner of professionals who remit taxes to government agencies.

Selling Price Final Price 1 Sales Tax Reverse Sales Tax Definition Have you ever wondered how much you paid for an item before the sales tax or if the sales tax on your receipt was correct. HST reverse sales tax calculation or the Harmonized reverse Sales Tax calculator of 2022 for the entire Canada Ontario British Columbia Nova Scotia Newfoundland and Labrador and many more Canadian provinces. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Our calculator has been specially developed in order to provide the users of the calculator with not only how much tax they will be paying but a. Now you can find out with our Reverse Sales Tax Calculator Our Reverse Sales Tax Calculator accepts two inputs.

New Jersey Sales Tax Calculator calculates the sales tax and final price for any New Jersey. Instead of using the reverse sales tax calculator you can compute this manuallyTo find the original price of an item you need this formula. Enter the sales tax percentage.

You obviously may change the default values if you desire. Other provinces in Canada do not use the HST and instead use a distinct Goods and Services Tax GST andor Provincial Sales. Reverse Sales Tax Calculator - 100 Free - Calculatorsio.

Enter the total amount that you wish to have calculated in order to determine tax on the sale. It determines the amount of gross wages before taxes and deductions that are withheld given a specific. The base state sales tax rate in New Jersey is 6625.

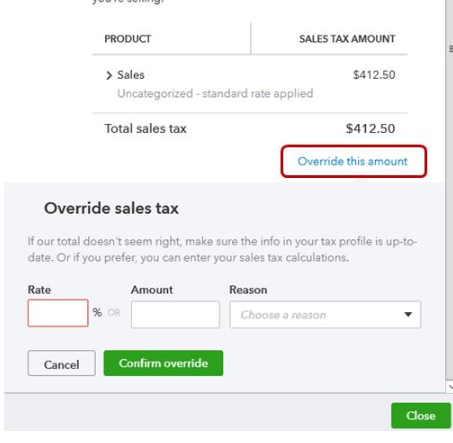

The Harmonized Sales Tax or HST is a sales tax that is applied to most goods and services in a number of Canadian provinces. This will give you the items pre-tax cost. Divide the price of the item post-tax by the decimal value.

Reverse Tax Calculator is a simple financial app that allows you to quickly and easily figure out just how much of that sales total was actually taxes. NJ-1065 NJ-CBT-1065 PART-200-T and CBT-206 Extension and prior year PART-100 Vouchers Partnership Return Filing and Payment. This calculator helps you determine the gross paycheck needed to provide a required net amount.

The Garden State has a lot of things going for it but low taxes are not among its virtues. Lets calculate this value. And is based on the tax brackets of 2021 and 2022.

Description Reverse Tax Calculator is a simple financial app that allows you to quickly and easily figure out just how much of that sales total was actually taxes. Enter the sales tax and the final price and the reverse tax calculator will calculate the tax amount and price before tax. The top tax rate in New Jersey is one of the highest in the US.

You are able to use our New Jersey State Tax Calculator to calculate your total tax costs in the tax year 202122. OP with sales tax OP tax rate in decimal form 1 But theres also another method to find an items original price. Local tax rates in New Jersey range from 000 making the sales tax range in New Jersey 663.

Order Now Offer Details. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax Amount without sales tax GST rate GST amount Amount without sales tax QST rate QST amount Margin of error for sales tax An error margin of 001 may appear in reverse calculator of sales tax. The Garden State has a progressive income tax system.

Overview of sales tax in Canada. Overview of New Jersey Taxes. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates.

New Jersey sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. 1050 cents per gallon of regular gasoline 1350 cents per gallon of diesel. New Jersey has a 6625 statewide sales tax rate and does not allow local governments to collect sales taxes.

It is mainly intended for residents of the US. Use this federal gross pay calculator to gross up wages based on net pay. The NJ sales tax calculator has the option to include tax in the gross price as well as the amount to be added to net price.

Order Now Offer Details. For example if an employee receives 500 in take-home pay this calculator can be used to calculate the gross amount that must be used when calculating payroll taxes. Simply enter the costprice and the sales tax percentage and the NJ sales tax calculator will calculate the tax and the final price.

New Jersey State Tax Quick Facts. Reverse sales tax calculator for Atlantic City New Jersey. The rates which vary depending on income level and filing status range from 140 to 1075.

This app is especially useful to all manner of professionals who remit taxes to government agencies. As well as entrepreneurs and anyone else who may need to figure out just how much of their sale should be recorded as tax. A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

Please note state sales. Estimated Tax Payments by E-check or Credit Card Pass-Through Business Alternative Income Tax. Fast and easy 2022 sales tax tool for businesses and people from Atlantic City New Jersey United States.

2675 107 25. Reverse Sales Tax Formula. Free online 2022 reverse sales tax calculator for Atlantic City New Jersey.

Subtract the price of. In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. Find your New Jersey combined state and local tax rate.

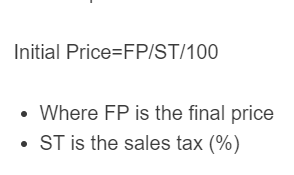

First enter the net paycheck you require. The 2022 tax values can be used for 1040-ES estimation planning ahead or comparison. How to Calculate Reverse Sales Tax Following is the reverse sales tax formula on how to calculate reverse tax Price Before Tax Final Price 1Sales Tax100 Tax Amount Final Price - Price Before Tax.

Like income tax calculating sales tax often isnt as simple as X amount of money Y amount of state tax In Texas for example the state imposes a 625 percent sales tax as of 2018. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. The first script calculates the sales tax of an item or group of items then displays the tax in raw and rounded forms and the total sales price including tax.

Now you divide the items post-tax price by the decimal value youve just acquired.

Excel Formula Abbreviate State Names Exceljet

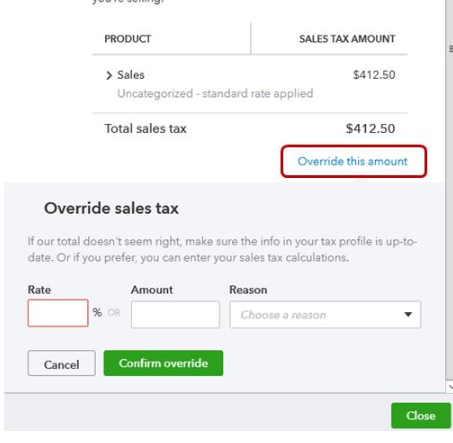

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

Us Sales Tax Calculator Reverse Sales Dremployee

Us Sales Tax Calculator Reverse Sales Dremployee

Reverse Sales Tax Calculator 100 Free Calculators Io

Sales Tax Reverse Calculator Internal Revenue Code Simplified

Cryptocurrency Taxes What To Know For 2021 Money

How To Calculate Sales Tax Backwards From Total

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

How To File Taxes For Free In 2022 Money

How To Calculate Sales Tax Backwards From Total

Reverse Sales Tax Calculator De Calculator Accounting Portal

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

Reverse Sales Tax Calculator Calculator Academy

Reverse Sales Tax Calculator 100 Free Calculators Io

Reverse Sales Tax Calculator Calculator Academy

Sales Tax Recovery Reverse Sales Tax Audit Pmba

Reverse Sales Tax Calculator Calculator Academy

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price