nevada estate and inheritance tax

In 2021 the first 117mil per individual is exempt at the federal level. Thorough estate planning will help you to.

Why Nevada Is One Of The Best States To Start A Business

NV does not have state inheritance tax.

. Does Nevada Have an Inheritance Tax or Estate Tax. An estate that exceeds the Federal Estate Tax Exemption of 1206 million becomes subject to taxation. It is one of the 38 states that does not apply an estate taxNevada.

No estate tax or inheritance tax. The probate process is not required in Nevada if the decedent has set up a trust or family trust. No estate tax or inheritance tax Arkansas.

The executor of a decedents estate uses Form 706 to figure. No Estate Tax Laws in Nevada To beneficiaries of an estate learning that inherited property is located in Nevada can feel like watching all three wheels of a slot machine land on. Each state has its own tax laws which govern taxation.

If you are an heir to an estate in Nevada you no longer need to wait for probate to close before you can use your inheritance. Does Nevada Have an Inheritance Tax or Estate Tax. Here are the answers to five common Nevada inheritance tax questions 775 823-9455.

Nevada Estate and Inheritance Tax Return Engagement Letter - 706 Find state-specific templates and documents on US Legal Forms the biggest online library of fillable legal templates. However an estate in Nevada is still subject to federal inheritance tax. Sales tax is one area where Nevada could do better.

Under Nevada taxation laws there is no provision for inheritance and estate taxes. The federal Estate Tax has a progressive rate that starts at 18 and can reach up to 40 significantly decreasing your inheritance. No estate tax or inheritance tax Arizona.

The state imposes a 685 tax and counties may tack on up to. Under Nevada law there are no inheritance or estate taxes. Whereas the inheritance tax is calculated separately for each individual beneficiary and the beneficiary is responsible for paying the tax.

Fortunately Nevada does not impose an. There are no estate or inheritance taxes in the state either. This means that you do not need to pay.

With an inheritance advance from Inheritance advanced you can. No estate tax or inheritance tax Alaska. Since the state does not impose an estate or inheritance tax upon death less money is deducted during probate than if the property was located in any other state in America.

No estate tax or inheritance tax California. If the time of death is on or after January 1 2005 Nevada does not require filing of Estate Tax and will not require filing until which time the Internal Revenue Service reenacts the Death Tax. Clark Nevada Estate and Inheritance Tax Return Engagement Letter - 706 Questions and Answers What is the purpose of Form 706.

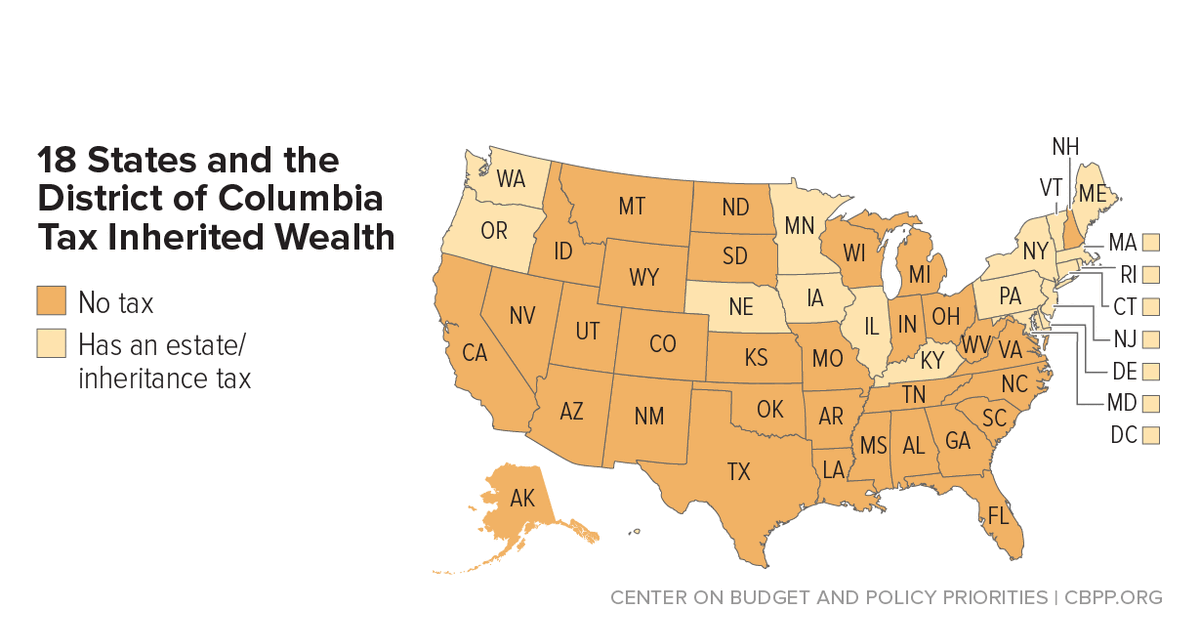

State Estate Taxes A Key Tool For Broad Prosperity Center On Budget And Policy Priorities

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Estate And Inheritance Taxes By State In 2021 The Motley Fool

State Death Tax Hikes Loom Where Not To Die In 2021

Nevada Vs California Taxes Explained Retirebetternow Com

Nevada State Taxes Everything You Need To Know Gobankingrates

Gift Annuity Regulations By State Crescendo Interactive

Estate Planning Nevada Legal Services

Are You Eligible To Receive A Step Up In Cost Basis On Inherited Property Heron Wealth

Minimize Your State Estate Taxes Through Proper Planning C W O Conner Wealth Advisors Inc Atlanta Georgia

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

A Guide To Reducing State Taxes On Capital Gains Understanding The Nevada Incomplete Non Grantor Trust

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Nevada Inheritance Laws What You Should Know

Nevada Income Tax Nv State Tax Calculator Community Tax

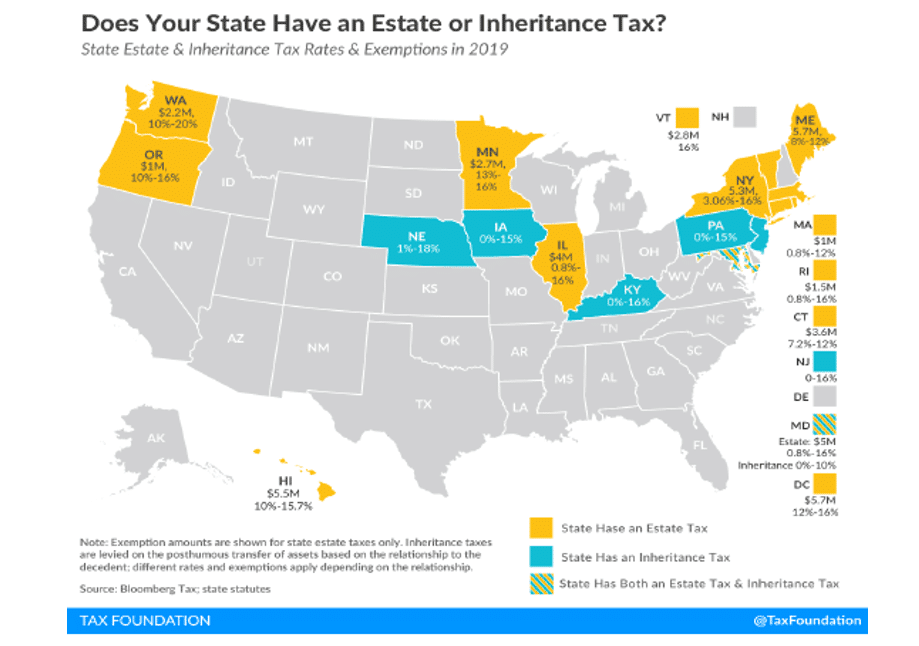

Does Your State Have An Estate Or Inheritance Tax

State By State Comparison Where Should You Retire